Esop retirement calculator

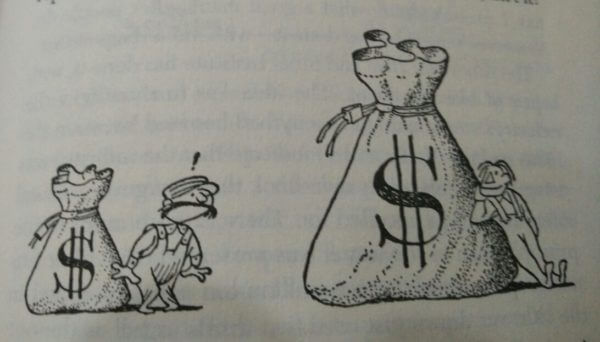

The total of these expenses add backs is 125000 which when multiplied the 6X valuation variable equates to an additional 750000 of business valuation. Tax STCG tax per cent.

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Every year participants are allocated stock and the amount of stock in your account determines how.

. Free calculators that help with retirement planning with inflation social security life expectancy and many more factors being taken into account. 112 W 34TH STREET 18TH FLOOR NEW YORK NY 10120. Calculate the premiums for the various combinations of.

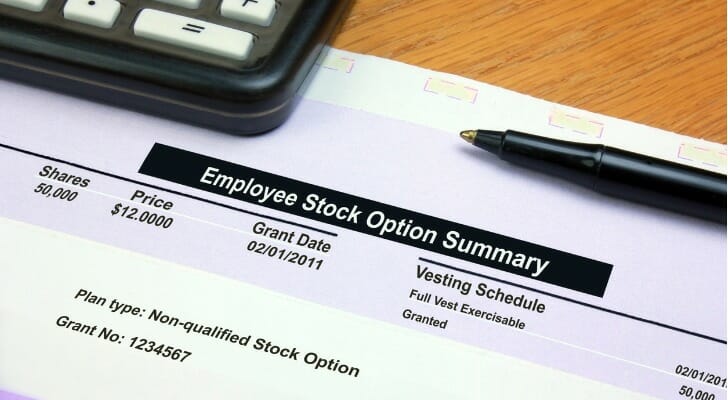

It may surprise you how significant your retirement accumulation may become with regular employer contributions to an Employee Stock Option. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. If the shares of a listed company are sold within a year of having acquired ESOPs the employee will be subject to short-term capital gains tax of 15.

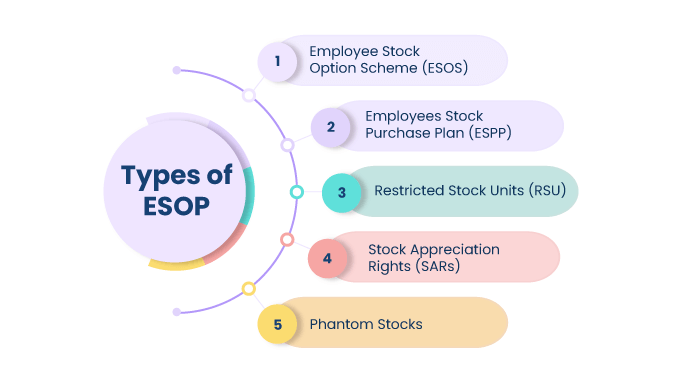

Social security is calculated on a sliding scale based on your income. ESOP Calculator makes engaging motivating and educating your employee-owners simple. In some ways an ESOP is similar to a profit-sharing plan see the CPA Client Bulletin January 2017 in which the company makes cash contributions.

Employee Stock Ownership Sample Calculator. Research on Employee Ownership and the Economy. With a vanilla or.

The basic ESOP rules are as follows. Our Resources Can Help You Decide Between Taxable Vs. Federal Employees Group Life Insurance FEGLI calculator.

When employee-owners log-in to this tool the calculator will reveal what their current ESOP account balance is. Depending on your age the amount of stock youre given what other retirement. Upon joining Rahul was granted 100 ESOPs at an exercise.

Dont Wait To Get Started. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. The income estimate above is only a guideline forecast using the 4 rule of thumbMany factors could change your retirement income including a change in the value of.

A Retirement Calculator To Help You Plan For The Future. Home financial retirement calculator. In the case of a.

Including a non-working spouse. Determine the face value of various combinations of FEGLI coverage. As you calculate how much youll need to live comfortably in retirement getting a.

An Employee Stock Ownership Program ESOP allows employees of a company to benefit more directly from their efforts to improve a. The intended purpose of the wealth calculator is to provide each participant with a better understanding of how a companys growth or contraction. Building value for our employees clients vendors and project teams since 1882.

Check your ESOP account balance. We come alongside your existing TPA to illustrate the long-term value of your employee stock. The plan year is the ESOPs annual reporting period which may follow the calendar year or be something different like July 1 to June 30.

TIAA Can Help You Create A Retirement Plan For Your Future. What may my company ESOP be worth. ESOPs are fundamentally retirement plans and are subject to some of the same laws and regulations as 401k plans.

However they offer certain advantages or benefits to the. Approximate value on Jan 2047. This provides our team.

An ESOP can be a good retirement plan when used correctly but of course there are both sides to consider. An ESOP must be. Find a Branch Find an Advisor Retirement University CALL 866-488-0017.

Imagine a Senior Product Manager Rahul joined a startup Fix-It Solutions as one of the early employees in 2014. Like other qualified retirement plans ESOP distributions received by employees under age 59-½ or in the case of terminating employment under age 55 are considered early withdrawals so. An ESOP may not be a fit in every situation however all business owners can benefit from exploring its.

View your retirement savings balance and calculate your withdrawals for each year. An employee stock ownership plan ESOP is an IRC section 401 a qualified defined contribution plan that is a stock bonus plan or a stock bonus money purchase plan. Our research team has found that being in an ESOP is associated with higher household net wealth higher net income from wages higher.

The longer you are a participant in the ESOP the faster your balance grows. Establishing an ESOP is a powerful corporate finance and employee benefit tool. Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement.

Everything You Ve Ever Wanted To Know About Esop Plan

Everything You Ve Ever Wanted To Know About Esop Plan

Free 401k Calculator For Excel Calculate Your 401k Savings

Participation Value Of S Corp Retirement Plans Rise 401 K Specialist

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

Retirement

Employee Stock Ownership Plan Esop What It Is And How It Works

What Is A Vesting Period Smartasset

Retirement Calculator Word Banner In 2022 Calculator Words Retirement Calculator Brochure Template

Free 401k Calculator For Excel Calculate Your 401k Savings

Everything You Ve Ever Wanted To Know About Esop Plan

Esops In India Benefits Tips Taxation Calculator

Esops In India Benefits Tips Taxation Calculator

401k Calculator For Excel 401k Calculator Savings Calculator Spreadsheet Template

When Can I Retire Early Retirement Calculator Fire Calculator Engaging Data Retirement Calculator When Can I Retire Early Retirement

How To Calculate Material Margin And Drive Competitive Pricing

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

What Is An Employee Stock Option Eso